Our planet is home to an astonishing diversity of life, with some of the most incredible animals found in the most unexpected places. Among these, certain species are so unique that they exist only within the borders of a single country, making them national treasures. These animals not only contribute to the ecological balance but also to the cultural identity of their home countries. Let’s explore 18 such remarkable creatures, each a testament to the wonders of nature and the importance of conservation.

1. Madagascar’s Lemurs

Madagascar, an island nation off the southeastern coast of Africa, is the exclusive home of the world’s lemurs. These primates are as diverse as they are endearing, with more than 100 species ranging from the tiny mouse lemur to the striking indri. Lemurs are not only a significant draw for ecotourism but also play crucial roles in their ecosystems as seed dispersers. Sadly, many lemur species are threatened by habitat destruction and hunting, making conservation efforts in Madagascar more critical than ever.

2. Australia’s Kangaroos

Kangaroos are synonymous with Australia, bounding across the continent’s diverse landscapes. These marsupials are well-adapted to Australia’s varied habitats, from the arid Outback to lush coastal areas. Kangaroos are a vital part of Aboriginal culture and Australian identity, appearing on the country’s coat of arms and currency. Conservation management is essential to balance their populations with agricultural interests, ensuring kangaroos continue to thrive.

3. China’s Giant Pandas

Giant pandas are the global symbol of wildlife conservation, found only in the bamboo forests of China. These iconic bears have a specialized diet of bamboo and play a significant role in their habitats by helping to spread bamboo seeds. China’s efforts to conserve giant pandas have seen their status improve from “Endangered” to “Vulnerable,” a significant conservation success story. Panda diplomacy has also made these creatures ambassadors of goodwill around the world.

4. New Zealand’s Kiwis

New Zealand’s kiwis are flightless birds with a suite of unusual characteristics, including long beaks and nocturnal habits. As national symbols, they hold a special place in the hearts of New Zealanders, affectionately known as “Kiwis” themselves. Kiwis face threats from introduced predators, and conservation programs are vital to protect these unique birds. Their continued survival is a priority for New Zealand’s conservation efforts.

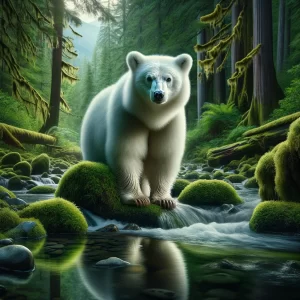

5. Canada’s Spirit Bear

The Spirit Bear, or Kermode bear, is a rare white variant of the black bear found only in British Columbia, Canada. Revered by indigenous peoples and a marvel for scientists, the Spirit Bear’s white coat is the result of a unique genetic trait. The Great Bear Rainforest is the primary habitat of these elusive creatures, and conservation efforts are focused on protecting this pristine environment from deforestation and industrial development.

6. Indonesia’s Komodo Dragons

Komodo dragons, the world’s largest lizards, are found only in Indonesia’s Komodo National Park and a few neighboring islands. These formidable predators are known for their impressive size, fearsome demeanor, and venomous bite. Komodo dragons are a significant draw for wildlife tourism in Indonesia, contributing to the local economy and funding conservation efforts. Protecting their habitats from human encroachment and ensuring a stable prey base are key to their survival.

7. Costa Rica’s Resplendent Quetzal

The Resplendent Quetzal is a vividly colored bird that calls the cloud forests of Costa Rica its home. Revered by the ancient Aztecs and Maya, the quetzal is a symbol of freedom and wealth. Conservation efforts in Costa Rica aim to protect the cloud forests and promote eco-friendly tourism, ensuring the quetzal and many other species continue to thrive in this biodiverse country.

8. Seychelles’ Aldabra Giant Tortoise

The Aldabra Giant Tortoise is one of the largest tortoise species in the world, found only in the Seychelles, specifically on the Aldabra Atoll. These gentle giants are among the world’s longest-living animals, with some individuals over 150 years old. Conservation efforts have helped their populations recover on Aldabra, and they are now a symbol of successful island conservation.

9. Indonesia’s Sumatran Tiger

The Sumatran Tiger, exclusive to the Indonesian island of Sumatra, is the smallest of all tiger subspecies and is critically endangered due to deforestation and poaching. These majestic predators are adept at navigating the dense tropical forests of Sumatra, playing a crucial role in maintaining the ecological balance. Conservation efforts focus on protecting their dwindling habitat and combating illegal wildlife trade to prevent the extinction of this iconic species.

10. Brazil’s Amazon River Dolphins

The Amazon River Dolphin, or Pink Dolphin, is a freshwater dolphin species found in Brazil’s Amazon River. These intelligent creatures are known for their pink coloration and playful behavior. They play a crucial role in local folklore and are considered a symbol of the Amazon’s biodiversity. Conservation efforts are essential to protect their habitat from pollution and overfishing, ensuring the survival of this unique species.

11. South Africa’s African Penguins

African Penguins, also known as Jackass Penguins for their distinctive braying sounds, are found only along the South African coast. These charming birds are adapted to the temperate climate and are a major draw for tourists. Conservation efforts, including habitat restoration and protection from oil spills, are vital for ensuring the survival of these unique penguins in the wild.

12. Sri Lanka’s Sri Lankan Elephants

Sri Lankan Elephants, a subspecies of the Asian Elephant, are an integral part of Sri Lanka’s cultural and natural heritage. These gentle giants are revered in Sri Lankan society and are a major attraction in wildlife reserves. Conservation initiatives focus on mitigating human-elephant conflicts and protecting their habitats, emphasizing the importance of coexistence between humans and wildlife.

13. Papua New Guinea’s Birds-of-Paradise

Papua New Guinea is renowned for its Birds-of-Paradise, known for their extraordinary plumage and elaborate courtship displays. These birds are a testament to the country’s rich biodiversity and are a key attraction for birdwatchers and nature enthusiasts. Conservation of Papua New Guinea’s rainforests is essential for ensuring the survival of these spectacular birds.

14. Borneo’s Pygmy Elephants

Borneo’s Pygmy Elephants, found in the dense forests of Sabah and Kalimantan, are the smallest subspecies of Asian elephants. Characterized by their gentle nature, relatively small size, and oversized ears, these elephants are an integral part of Borneo’s biodiversity. Conservation initiatives are crucial to protect them from habitat loss and human-elephant conflicts, ensuring the survival of these gentle giants.

15. Ecuador’s Galapagos Tortoises

Galapagos Tortoises, native to Ecuador’s Galapagos Islands, are among the longest-living vertebrates on Earth. These giant tortoises have become synonymous with the islands and are a key focus of conservation efforts. The Galapagos Tortoises played a significant role in Charles Darwin’s theory of natural selection, making them an emblem of scientific discovery and conservation.

16. United States’ American Alligators

The American Alligator, native to the southeastern United States, is a formidable reptile that inhabits freshwater wetlands, marshes, and swamps. Once on the brink of extinction, successful conservation efforts have led to a remarkable recovery, making it a conservation success story. These ancient reptiles are not only vital for maintaining the ecological balance in their habitats but also serve as a symbol of wildlife resilience and recovery.

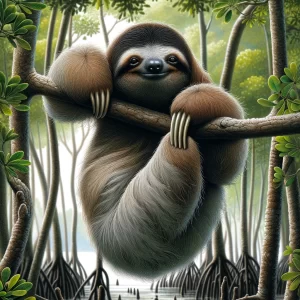

17. Panama’s Pygmy Three-Toed Sloths

The Pygmy Three-Toed Sloth, exclusive to Panama’s Isla Escudo de Veraguas, is one of the world’s smallest and most endangered sloth species. Characterized by their diminutive size and leisurely lifestyle, these sloths are adapted to the mangrove forests of this remote island. Their critical status highlights the urgent need for conservation efforts to protect their limited habitat and ensure the survival of this unique species.

18. Australia’s Platypus

The Platypus, native to eastern Australia and Tasmania, stands out as one of the most unusual mammals in the world, featuring a duck-like bill, webbed feet, and the ability to lay eggs. Inhabiting rivers and freshwater lakes, this elusive creature is a symbol of Australia’s unique wildlife and ecological diversity. Conservation efforts are vital to protect their freshwater habitats from pollution, dam construction, and climate change, ensuring the survival of this extraordinary species.

Appreciating These Incredible Animals Unique to Only One Country

These 18 animals, each unique to just one country, remind us of the incredible diversity of life on our planet and the importance of conservation efforts to protect these irreplaceable treasures. From the dense forests of Madagascar to the rugged Australian Outback, from the bamboo groves of China to the cloud forests of Costa Rica, these creatures not only enrich our natural world but also embody the cultural heritage and environmental challenges of their respective nations. Preserving their habitats and ensuring their survival is not just a national duty but a global responsibility, a testament to our shared commitment to protecting the planet’s biodiversity.