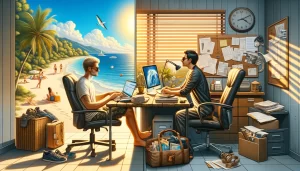

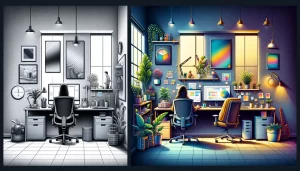

Digital nomads and 9-5 workers can lead very different lives. The arrangements present two contrasting yet equally fascinating lifestyle paradigms. As technology continues to reshape the workplace, more individuals are exploring the digital nomad lifestyle, which is characterized by remote work and geographical freedom.

Meanwhile, many still adhere to the conventional 9-5 work schedule, finding value in its structure and stability. Here are 12 unique insights into the lifestyles of digital nomads and 9-5 workers, highlighting the nuances and trends that define modern work culture.

1. Work-Life Balance

Often hailed for their ability to blend work with travel, digital nomads typically have the flexibility to design their schedules around personal interests and activities. However, this freedom can sometimes blur the lines between work and leisure, leading to challenges in establishing a clear work-life balance.

Traditional office workers usually have a more defined separation between work and personal time. While the 9-5 structure provides predictability, it can also limit personal freedom during the workweek, potentially leading to feeling trapped in a routine.

2. Location Independence vs. Stability

The essence of being a digital nomad lies in location independence, allowing individuals to work from anywhere with an internet connection. This mobility can lead to exciting travel opportunities but also comes with a sense of transience and lack of community.

Conversely, 9-5 workers often benefit from a stable work environment and a consistent community. This stability supports long-term relationships and a sense of belonging, though it may limit exposure to new cultures and experiences.

3. Social Connections

Building and maintaining social connections can be challenging for digital nomads due to their transient lifestyle. While they often meet new people, forming deep, lasting relationships requires more effort and intentionality.

Office workers typically have more opportunities to develop long-term social connections with colleagues, benefiting from daily interactions and shared experiences. However, these relationships are often confined to the workplace.

4. Financial Stability

Income for digital nomads can fluctuate based on client work, project availability, and the ability to secure consistent remote work. This unpredictability can affect financial planning and stability.

Those in traditional employment usually enjoy a steady paycheck, benefits, and potential career advancement opportunities. As a result, they enjoy a more predictable financial landscape.

5. Professional Development

Continuous learning and self-motivated professional development are crucial for digital nomads to remain competitive. The challenge is that they often have to seek out their opportunities for growth and learning.

Traditional workplaces often provide structured opportunities for professional development, including training, workshops, and mentorship programs, facilitating career progression within the organization. As a result, professional development is more accessible.

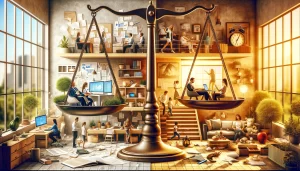

6. Productivity and Motivation

Without a traditional office structure, digital nomads must be self-disciplined to maintain productivity. The freedom to choose work hours and environments can lead to higher motivation and efficiency for some, but may cause challenges for others.

The structured environment of a 9-5 job can enhance focus and productivity for those who thrive on routine. However, it can also lead to monotony and decreased motivation over time.

7. Lifestyle Flexibility

The digital nomad lifestyle offers unparalleled flexibility in terms of living arrangements, travel, and daily routines. In many cases, that’s appealing to those who value freedom and variety.

While 9-5 workers have less flexibility during the workweek, many find comfort in the predictability and stability of their routine. At times, it’s also easier to plan for leisure activities and family time, as schedules and locations are relatively set.

8. Technological Dependence

A digital nomad’s lifestyle is heavily reliant on technology. Not only is it crucial for work, but it also plays a significant role in maintaining social connections, managing logistics, and accessing information on the go.

While technology is also integral to traditional work settings, 9-5 workers may experience less dependence on digital tools during their time. That could make for more digital detox opportunities.

9. Adaptability and Resilience

Constantly changing environments and the need to navigate different cultures enhance adaptability and resilience among digital nomads, skills that are invaluable in both personal and professional realms. For 9-5 workers, stability and routine can foster a deep understanding of specific job roles and industries, though it may limit exposure to diverse challenges and problem-solving opportunities.

10. Health and Wellness

The nomadic lifestyle can support a focus on health and wellness, with opportunities to explore outdoor activities and fitness routines. However, constant travel can also disrupt healthy habits and access to healthcare.

Typically, 9-5 workers have more consistent access to healthcare and regular fitness routines. However, office-based workers can face challenges like sedentary lifestyles and workplace stress.

11. Environmental Impact

The travel-centric nature of digital nomadism raises questions about its environmental impact. This is particularly true as it relates to carbon emissions from frequent flights and the use of disposable products.

Traditional office settings can contribute to environmental issues, too. Energy consumption, commuting, and waste generation are potentially part of the equation, though many companies are now adopting greener practices.

12. Personal Fulfillment

Many digital nomads find personal fulfillment in the freedom, adventure, and cultural experiences their lifestyle affords despite the challenges of instability and isolation. Fulfillment for 9-5 workers often comes from career achievements, workplace camaraderie, and the ability to support stable family life, underscoring the diverse paths to personal satisfaction.

Digital Nomads and 9-5 Workers Live Different Lifestyles

Ultimately, both digital nomads and 9-5 workers navigate unique lifestyles with distinct advantages and challenges. Understanding these insights helps highlight the diversity of work-life experiences in the modern era, emphasizing the importance of choosing a path that aligns with one’s personal values, goals, and definitions of success.