Without the right tools at your disposal, managing your finances can be unnecessarily difficult. There are many tools to help you reach your goals, make financial planning more enjoyable, and teach financial literacy. Here are 10 financial management tools that are absolute game changers.

1. Financial Calculator

Why do everything by hand when you can have the help of a financial calculator? This financial calculator from Texas Instruments solves time-value-of-money calculations such as annuities, mortgages, leases, savings, and more. Customers give this calculator 4.6 stars on Amazon and love how reliable it is.

2. Budget Planner

If you prefer budgeting by hand rather than digitally, a budget planner is a must-have. This budget planner helps you take control of your finances by keeping track of your daily spending, expenses, financial goals, savings, and debt. Customers find it simple to use and convenient with a quality design.

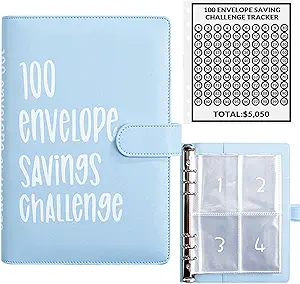

3. 100 Envelopes Savings Challenge Organizer

Have you heard of the 100 envelopes savings challenge? This fun savings method can help you save $5,050. With this 100 envelopes binder, you’ll be able to stay organized as you save money. Customers on Amazon give the binder a 4.7 rating and say that it is a simple and fun way to save.

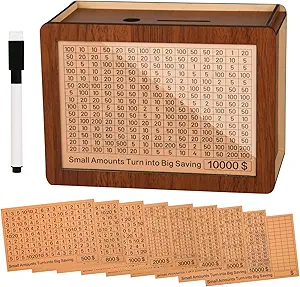

4. Savings Box

This wooden cash vault is perfect for teens or adults to track their savings. You can choose between a variety of dollar amounts that you’d like to save. The box then displays different amounts that you can mark each time you put money in the cash vault. The box is much more attractive than a piggy bank and lets you see your progress easily.

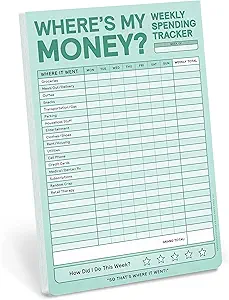

5. Weekly Spending Tracker

If you don’t know what money is going out, it’s hard to manage your money effectively. This simple weekly spending tracker can help you and your family see exactly how your money is being spent.

6. Savings Challenges Book

If you’re looking for ideas on how to reach your savings goals, this savings challenges book can give you the inspiration you need. Customers on Amazon give it a 5-star rating and say that the challenges make saving money both practical and fun.

7. Quicken Software

If you want to save time managing your finances, Quicken software can help you. Quicken can be purchased through Amazon and updated every year for a great price. With Quicken, you can connect all of your accounts, debt, and investments. The software will help you manage & grow your savings, create custom budgets & track spending, and project different debt scenarios.

8. Debt Payment Planner

Is one of your goals to get out of debt? Some people need extra motivation to pay down their debt. With this debt payment planner, you can use the snowball or avalanche to pay off debt.

9. Credit Score Journal

If you’re paying off your credit card debt, you may want to track your credit score progress with the credit score journal. This way you track where you’ve been and how far you’ve come.

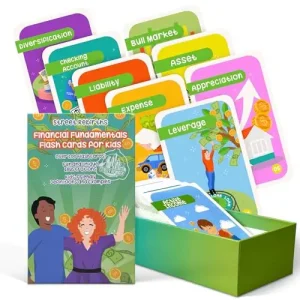

10. Financial Literacy for Kids

It’s never too early to start teaching kids about financial literacy. These financial literacy flashcards are a game changer for young adults. Customers gave this 110 flashcard set 5 stars with many saying that the explanations are simple and easy to explain. Plus, money lessons become family fun time thanks to these flashcards.

How do you manage your money? Do you have any game-changing financial management tools that you use?

Read More

6 Tips You Should Know to Keep Your Credit Balance From Impacting Your Credit Score