Lending Club is a great tool for making some very nice passive income. I’ve been using my account to invest some funds and see what I can do as far as a return, as well as to learn more about the service and what can be done with it. As someone who lives in a state where the direct investing isn’t allowed (state laws that need changing), I use the FolioFN trading platform within Lending Club to make my investments. This eats into my return a bit, as I pay a small premium to the original investor when I buy the investment. However, I’m finding that even with that small premium, my return is still far above what I am making in any savings account. If you’d like to start at the beginning of the year, you can read my 1Q2012 and 2Q2012 updates first then come back to this one.

Lending Club Returns Growing

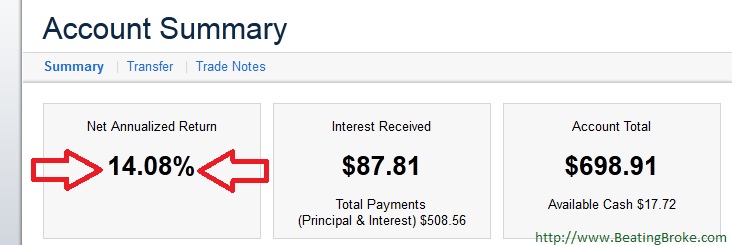

After the last update, in July, I made the decision that I could increase the risk level a bit on the my portfolio and still safely be in a place where it wasn’t too high. While I don’t have a direct history of working at a commercial lender, I did work in I.T. at a Credit Union. (Also, I did not sleep at a Holiday Inn Express last night.) In my position there, I learned a few things about the way the backend of an institution works. And, what I can tell you is that the credit scores that are getting C and even D ratings on Lending Club would be the average borrowers at a commercial brick-and-mortar institution. What that tells me is that even the C and D rating loans at Lending Club are still a pretty safe investment. After all, if the banks and credit unions couldn’t make money on them, they wouldn’t loan to them. So, I increased my lending in the C and D ranges and have now moved the middle of my portfolio into the C/C- range. It’s weighted a bit riskier, but the reward is a bit higher as well. At the end of 2Q2012, my rate was stated on my dashboard as 13.58%. At the end of 3Q2012, that rate has increased to 14.08%.

A half a percent increase doesn’t sound like much, but it’s twice what my local savings account pays! If I’d have dumped that money into my savings account instead, I’d be making half of just the increase I made last quarter. Sad, no?

Delinquencies and Diversification on Lending Club

If you read the 2Q2012 update, you’ll know that I had two loans that have entered into the delinquency statuses. One of which, I was able to immediately sell on FolioFN for the outstanding principle. I lost the interest, but also lost the risk of it becoming a written off loan. The other had a very low principle balance on it, so I decided to keep it to see what would happen, and to force myself through the collection process should it have gone that far. It did not. The loan went so far as to become 31-120 days past due and then a payment was made that brought it current. It has remained current since then.

This is a good time to talk about diversification too. As you can see from the above screenprint, I have just under $700 in my Lending Club account. Nearly all of that (except the $17.72 in available cash) is invested into loans. All told, I have investments in 37 loans currently. That’s an average investment of about $18.50 per loan. Obviously, some of them are nearing payoff, and others are nearer funding, so the actual amount per loan varies wildly between $0 and $25. I do try and keep each investment to about $25-$30 to maintain that diversification. If any one of the loans were to go into collections and then be written off, I’m only loosing a small fraction of my overall portfolio, and the hit would be minimal.

Much like any other investment, whether it be in stocks, real estate, etc, diversification can greatly improve your risk tolerance. The risk of having one or two loans that go bad is far outweighed by the fact that you’d still have 10, 20, 30, or more loans that are in a current status. I’ll continue to monitor for loans that go past due and then decide individually whether to keep them or to try and liquidate them through the FolioFN trading platform.

Other notes

Over the last quarter, my Lending Club account has reached a point that the principle payments combined with the interest payments exceed $25 a month. What that means is that part of my experiment is complete. I’ve been able to create a portfolio of self-sustaining investments. I can stop putting any new funds into the account, and be able to reinvest the returns each month without having a whole lot of dead money sitting around waiting on me to invest it. At most, any funds from payments should only sit around for a maximum of about 30 days. It’s not ideal, but it’s far better than it could be.

I don’t intend to completely stop adding funds to the account either. I want the portfolio to grow at a slightly faster clip than it would with just the returns and payments, so I’ll continue making deposits into it. I like the way the portfolio is currently balanced, so will likely try and keep it that way. What that likely means is that I shouldn’t expect to see any major movement on the rate of return. I’m happy with the 14% I’m currently getting though, so that isn’t really a problem for me.

How many of you have not invested in a P2P lending account like the mine at Lending Club or at Prosper? Why not?

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.

Never really considered it but maybe it’s something to look into further. Thanks for planting that idea 🙂

I haven’t yet but am considering it for an experiment on my blog. My main concern as I always note is the tax consequences.

I just added a monthly $25 auto deposit every payday for the rest of the year, so I should be growing my account quickly now.

looking like you’re doing great here Shane! I’m at the 25/mo returns as well, and it’s working out swimmingly. I’m considering putting more into the program around the end of the year, depending on my cash situation.

Last I checked, it’s still not offered in my state. 🙁

Thanks for the helpful tip. I did not know the C and D rated borrowers were the same that most banks lend to. Interesting…I thought people used P2P loans because banks denied them.

@20’s Finance Even the FolioFN? I know there’s still about 5 states that they don’t even offer FolioFN in, but it’s coming down.

@Jamie Don’t get me wrong, the C and D loans are still riskier than the A and B loans, but most lenders would still borrow to them. The reason most people use P2P loans is because they can get better rates with the P2P lenders.

Actually, you’re right – it is available with the FolioFN. I’ll have to research the additional fees and the process required. Interesting…

@20’s Finances I wrote a little about how I choose loans in the FolioFN platform here: https://www.beatingbroke.com/lending-club-selecting-investments/

Also, if you have any questions, don’t hesitate to send me an email. admin@domain

I’ll definitely have to get in this game — my sister swears by it. Her return rate is really good, too.

Beating Broke rocks! I just shared this article on my site. Two qualities stand out, transparency and courage. Keep it up!