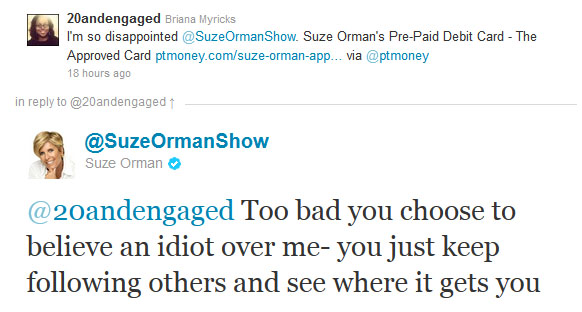

One of the biggest surprises about the whole Suze Orman “Approved Prepaid” Scam/Fiasco, to me, is that Suze Orman is a person who has been a role model, financially, for many people. She has been dispensing her brand of advice for many years, has multiple best-selling books on the subject, and regularly appears on news and talk shows trying to help people lead better financial lives. So, to have someone of that public stature, essentially attack someone I know and trust, led to some amount of disappointment. Disappointment in how she portrayed herself, and, also, eroded the trust that many had in her and her advice. (I should note that I never really cared for her style or advice, but many do and did.)

So, how do we overcome that level of disappointment when someone we trust to give good advice, and to behave in a professional manner, doesn’t?

- First and Foremost, remember that the person is human. People have bad days. They have lives outside of the limelight, and sometimes that life can bleed over and cause them to do or say things that are uncharacteristic.

- Remember that it’s still just advice. You should be doing your own research and assessing what is right for you in any situation. Remember when your mom would ask you “If your friends jumped off a bridge, would you do the same?” Well, the obvious point she was trying to drive home was that you need to be an independent thinker. Whenever someone recommends a product, service, or action, you have to determine if you should take that advice, or find an alternative.

- Express your disappointment. Many times, people will disappoint us and not even know they’ve done it. Tell them why they’ve disappointed you. Do it constructively, don’t be a jerk. If they truly meant well, they’ll want to know, and they’ll want to find a way to improve.

- Move on. Take what you have into account, and decide if you can continue to trust the person’s advice. If you can, let it go, and move on. If you can’t, let it go, and move on. (See what I did there?) Holding a grudge, or reacting negatively won’t help you, and it will reflect poorly on you.

People are disappointed with their role models all the time. People that we hold in high regard do something stupid, and fall from our good graces. It’s important to take the lessons that are available, improve upon your filter, and move on.

As I mentioned in the previous post, I don’t think that Suze Orman’s card is, necessarily, a bad card. I think it’s entirely possible that she created the card with the best intentions, and truly believes that it can be a useful tool for those that use it. I do think that the marketing for the card is far too broad, aimed at people who shouldn’t be using the card at all. I do think that she (or whomever is running her twitter account) overreacted to the criticism that was being presented by PT and others. Suze lost a lot of trust with a lot of personal finance writers over the whole fiasco. Depending on how the fallout from the whole situation lands, she might get some of that back, she might not. But, it’s those writers, expressing their disappointment, that might save a few people from using the card when they shouldn’t. It’s those same writers that may cause Suze to change her course, and improve upon the card based on the recommendations they made.

Disappointment is normal. We feel it all the time. How we react to it, and handle it, is what makes the difference.

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.