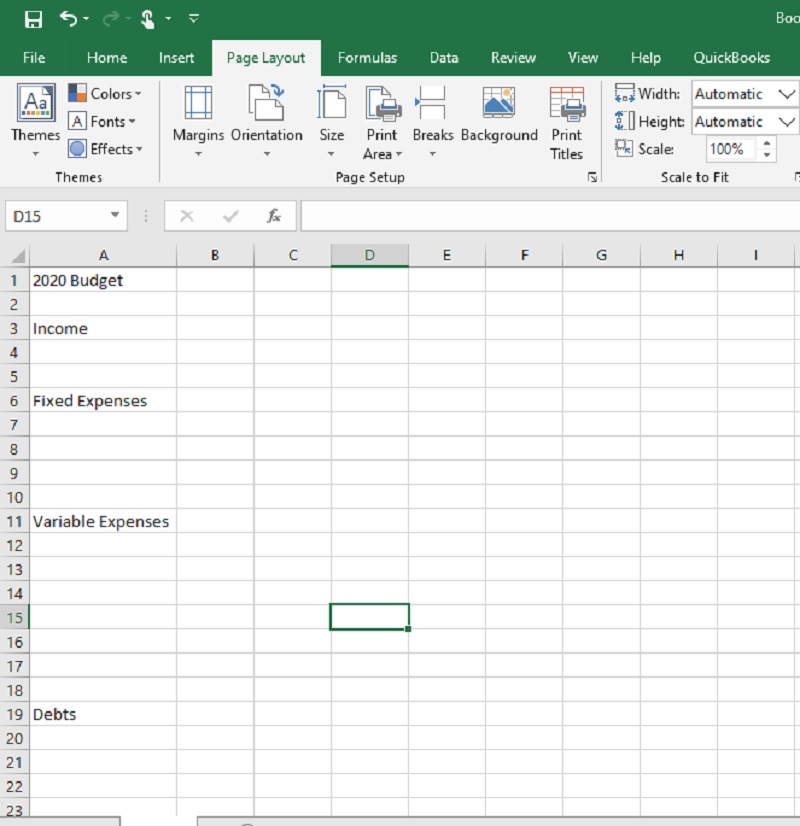

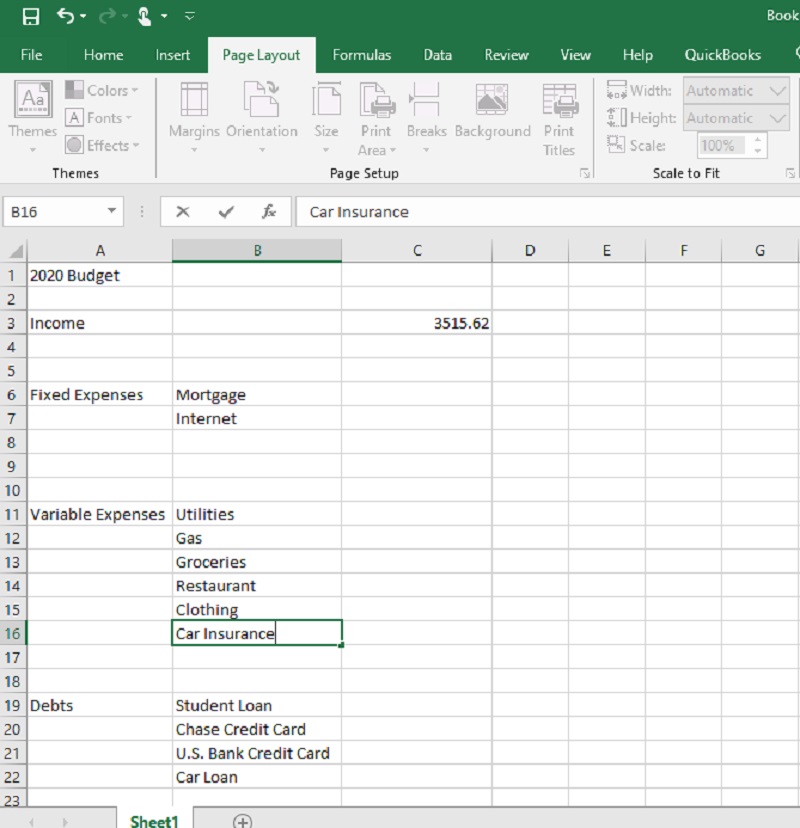

Years ago, when my husband and I were first married, I had a budget binder. It was simply a spiral notebook, and on each page, I put a different budget line item such as “groceries” or “electricity.” Each time we were paid, I put a certain amount in each category. When I paid a bill, I deducted the amount from that category. It was a tedious process, especially in a category that had a lot of deductions, like groceries. In desperation, I started researching budgeting software. I tried several before finally settling on You Need a Budget (YNAB). There are so many ways that YNAB changed our finances!

What Is YNAB?

You Need a Budget (YNAB) is a budgeting software based on the envelope system of budgeting.

The YNAB Principles

The YNAB system has four principles.

Give Every Dollar a Job

Using YNAB, you should budget every single dollar that you receive. Doing this helps you map out how to spend your money. If you have $40 left in your grocery category, you might need to have a small shopping trip and eat up the items in your pantry so you can keep within your budgeted amount.

Embrace Your True Expenses

Your true expenses are not just the ones that are due every month. You also have to budget for those expenses that you only pay once or twice a year like car insurance, property taxes, home insurance, and car registration. You should also budget for irregular expenses such as vet and medical bills.

Roll with the Punches

Your budget is flexible. If you only have $40 left in your grocery budget but your food costs $75, you can move $35 from another category to cover the overage. Things happen—roll with the punches.

Age Your Money

![]()

The age your money principle refers to how long it takes you to use the money that comes in. If you have money coming in that you don’t have to use for 30 days, your money is 30 days old. The longer you use YNAB, usually, the older your age of money is. Currently, our age of money is 73 days.

YNAB Trainings

YNAB has many free training videos, so you can watch those to learn more about the principles in YNAB and budgeting. In addition, the creator of YNAB, Jessie Mecham, wrote a book, You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want, that you can also read to learn about the YNAB system in-depth.

How YNAB Changed Our Finances

I started using YNAB over six years ago, and the program has revolutionized how I handle our finances.

Electronic Version of My Budget Binder

At its core, YNAB is an electronic version of my old paper budget binder.

Easier to Use than Paper

However, using YNAB is so much easier! All of those calculations I used to do on paper? YNAB does them automatically.

More Flexibility

Plus, when I put in an expense, I have the option to split the cost into several categories. So, if I spend $70 on Amazon, I can split the expenses into separate categories such as $45 for groceries, $15 for toiletries, and $10 for spending. I love that flexibility, and the process is so much easier and quicker than doing it by hand.

YNAB Is Portable

Plus, I can always consult my YNAB budget on my cell phone. I never carried around my budget binder previously, so I would have to guess how much I had left in each category.

Create a Budget Buffer

Besides being easier to use than my clunky budget binder, YNAB taught me new budgeting principles such as creating a buffer. When you first start using YNAB, you’re encouraged to create at least a one-month buffer. That means that slowly you start covering next month’s expenses with this month’s money. Say, at the end of the month you have $150 leftover. You don’t go out to eat to celebrate. Instead, you take that money and put it in some of your categories for next month. Then, slowly, you keep adding until you have all of your categories for next month covered with this month’s money.

Having a buffer gives you an automatic one-month emergency fund and gives you a sense of security. It also makes budgeting easier. You can pay all of your bills at the beginning of the month instead of waiting until you get your paychecks during the month because the money is waiting to do its job.

Can See Your Finances in One Glance

What I love most about YNAB is that my husband and I can see our finances at a glance. Since I do all of the budgeting, YNAB allows my husband and I to sit down every one or two weeks and together look at where we stand financially. My little budget notebook never made much sense to him, especially because he’d have to flip through 20 pages to see the amount of money in each of our categories.

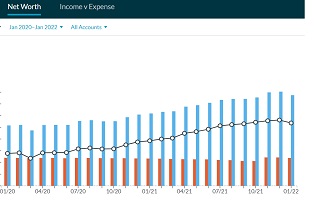

Easy to Track Net Worth

The best feature is the net worth feature. Often when we feel like we’re not making much progress financially, we look at our net worth and see that we are improving our bottom line. We sit down together at the end of each month to go over our net worth.

YNAB’s Price Increase But We Kept It

Recently, YNAB had a significant price increase. I thought about searching for a cheaper budgeting software. However, my husband said no, he wanted to stick with YNAB. He feels it is a valuable tool that makes budgeting and money management easier for me. In addition, he loves how easily he can keep up to date with our finances thanks to the program. He feels that YNAB is well worth the price, even after the price increase, so we’re staying.

Final Thoughts

YNAB has changed our finances and made them so much easier to manage. If you’re looking for budgeting software, I highly recommend You Need a Budget.

Read More

Feed a Hungry Teenager Without Breaking Your Grocery Budget

6 Unexpected Baby Expenses to Budget For

How to Feed Your Family on a Low Budget

P.s. if you’re looking for a good all around quality site to review while you’re working with YNAB, consider Moneycrashers.com. I’ve been following them for year – and their advice is generally really solid.

Melissa is a writer and virtual assistant. She earned her Master’s from Southern Illinois University, and her Bachelor’s in English from the University of Michigan. When she’s not working, you can find her homeschooling her kids, reading a good book, or cooking. She resides in New York, where she loves the natural beauty of the area.