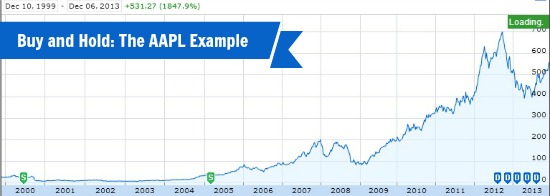

Experts are fond of telling us all about the historic returns of the stock market. But, does our belief in that make us overconfident in the stock market?

You’ll have a hard time finding someone who won’t tell you that the market performs quite admirably over time. It may have it’s ups and downs, but it performs at a rate that touches on double digits for longer periods of time. And, it’s hard to argue with the facts. Take the market for any given 10 or so year period and you aren’t likely to find too many periods where it hasn’t returned a pretty nice rate. Especially when you compare it to the rates of savings accounts and CDs over the same period.

But, there’s shady side to all of that. Our confidence in the ability of the stock market to return those kinds of numbers can sometimes cause us to over-invest our portfolios. Every time the stock market drops significantly (or crashes altogether) we hear stories about the person who was near retirement and now has to work for another 10 years because he/she lost it all in the stock market drop. Invariably, you hear one of the reporters utter something about whether the stock market is as safe as we all make it out to be.

And the truth is, no. It’s nowhere near as safe as some would make it out to be. In fact, it’s down-right risky. And the less diversification you have, the riskier it becomes. Hold all your money, or a significant portion of your portfolio, in one stock and you’re just as likely to suffer a tragic loss than you are to retire rich. Ignore the more conservative professionals who suggest that you should move more and more of your money away from stocks and into something like bonds as you age, and you have a much higher chance of suffering a tragic loss.

And the truth is, no. It’s nowhere near as safe as some would make it out to be. In fact, it’s down-right risky. And the less diversification you have, the riskier it becomes. Hold all your money, or a significant portion of your portfolio, in one stock and you’re just as likely to suffer a tragic loss than you are to retire rich. Ignore the more conservative professionals who suggest that you should move more and more of your money away from stocks and into something like bonds as you age, and you have a much higher chance of suffering a tragic loss.

Our confidence isn’t entirely misplaced, however. The facts remain that the market does return a healthy rate over time. Alongside traditional investments, exploring alternative investment strategies can also add value to your portfolio. While stocks and bonds play a crucial role, diversifying into different financial instruments ensures a balanced approach to investing, mitigating risks associated with market volatility. As long as you can weather a few down trends, you’re likely to come out on top if you just hold on for the ride. The overconfidence comes when you keep your money in too high of a percentage of stocks as you near retirement age. By the time you are 10-15 years from retirement (about age 50-55) you should have moved at least 50% of your portfolio away from stocks and into bonds. Your investment adviser should be able to help you with that, or you should sign up with a stock advisor service (like the Motley Fool Stock Advisor, or Betterment). When you’re 5 or so years from retirement, you should be closer to 90% in bonds and other safer investments. Yes, these investments are less likely to have high returns, but they also are almost guaranteed to return something. And, as the old saying goes, something is better than nothing.

The bottom line is this. Be aware of the risk of the stock market and that you should begin playing it safer as you near retirement age and you should be ok. Don’t get overconfident in the history of the stock market and it’s giant returns. Most importantly, find an investment adviser that you can trust and, at the very least, get their advice on your portfolio and it’s allocations, and you should find yourself hitting retirement with most of the money you expected to be there.

Image Credit: Charging Bull by kdinuraj, on Flickr

This post originally appeared on Beating Broke on 10/25/2010, and has been refreshed.

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.