For the longest time, my husband and I had simple Tracfone flip phones in case of emergency. We mainly used them just to keep up with one another, if necessary. We didn’t even have texting. But then my husband found it necessary to have a cell phone for work. We didn’t want to be strapped to a cell phone provider who would charge us a hundred dollars a month or more, so we decided to go with Ting, which has no contract requirement. I love to share with people how we save money with Ting as our cell phone provider because it helps us maintain a modest budget.

How We Save Money with Ting as Our Cell Phone Provider

We’ve upgraded to smart phones. We can now text, call, search the internet, etc. just like most people in the United States. However, by using Ting, we’ve found several ways to cut our costs.

Basic Ting Services and Charges

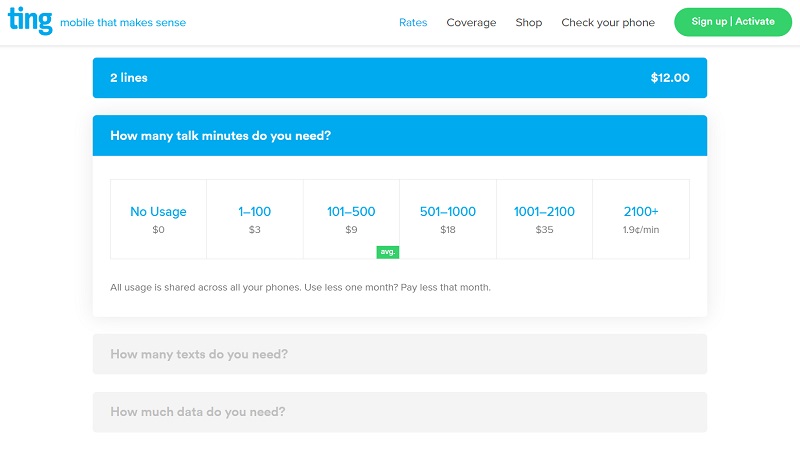

Ting is a provider who charges based on your usage.

Phone Line Charge

Each line that you have on the plan costs $6 a month. So, for my husband and I, there are two lines. We pay $12 a month for these.

Talk Minutes

There are also base rates for the minutes that you use to talk on your phone.

- 1 to 100 minutes = $3,

- 101 to 500 minutes = $9,

- 501 to 1000 minutes = $18, etc.

Texts

And there are base rates for texts.

- 1 to 100 texts = $3,

- 101 to 1000 texts = $5,

- 1001 to 2000 texts = $8, etc.

In addition, you will also pay taxes and regulatory fees monthly.

Limit Our Usage

Since Ting is basically a pay as you use provider, we try to limit our usage to keep our bills low. From October 2019 to February 2020, our monthly bill averaged $63. The highest bill was $84 in October when I was traveling, and the lowest was $46.

Once the pandemic hit and we began to stay home most of the time, our monthly bill dropped to $30.

If you want to focus on keeping your bill low, you can set up usage alerts, such as an email sent to you once you use 450 megabytes, so you don’t go over the 500 megabyte limit before moving into a different charge rate.

You can also enable settings that don’t allow you to make any more texts after a certain number, etc. This is very helpful if you have teens on your plan. This allows you to keep their usage within the confines of your budget.

Basic Phones

Ting also sells phones. My husband and I try to go with the most basic model available. The current phones we use cost less than $200 apiece. (We bought them during a sale Ting was having.)

We also use a cell phone case to keep our phones in good shape. My husband and I have both dropped our phones, but they were not damaged thanks to the cases.

Final Thoughts

While we wanted more modern cell phones, we didn’t want to pay a lot for them every month. The strategies given above are how we save money with Ting as our cell phone provider. Ting is not in every area, but you can see if they’re in your area by entering your area code on their website.