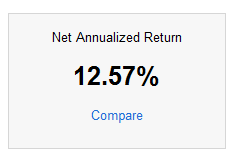

You already know that I like Lending Club as an investment vehicle. The returns are good (or great, depending on your default rate), and I like the idea that my money isn’t going to line the pockets of some corporation, but is being used to help someone who needs a loan get a better rate than they might get at a financial institution or through credit card usage.

Recently, Lending Club started offering IRA accounts to the lenders. My first thought, was something along the lines of “that sounds kinda cool”. But, then I got to thinking about it. Many of us struggle to put money away for our retirements. Do we really want what little money we have put away in an investment that carries as much risk as Lending Club notes carry? I like risky investments, but even I don’t think I’d want all of my retirement money in these notes.

One use that could redeem it is using it as a supplemental IRA. If you’ve already got a 401(k) and an IRA that you use to invest in more traditional, lower risk, investments, you could use a Lending Club IRA as a way to diversify further and add a little more risk to your portfolio. That would also allow for keeping a higher percentage of your 401(k) and standard IRA in investments that are a little less risky. Of course, that would also mean balancing your investment portfolio over several accounts.

One use that could redeem it is using it as a supplemental IRA. If you’ve already got a 401(k) and an IRA that you use to invest in more traditional, lower risk, investments, you could use a Lending Club IRA as a way to diversify further and add a little more risk to your portfolio. That would also allow for keeping a higher percentage of your 401(k) and standard IRA in investments that are a little less risky. Of course, that would also mean balancing your investment portfolio over several accounts.

I tried to figure out some of the finer details of the Lending Club IRA through their site, but either it isn’t all that clear, or I’m just a bit dense. 😉 So, I emailed them to get a few questions answered. Here’s what I found out. The accounts are administered through a company called Self Directed IRAs. I’m not all that familiar with what a self directed IRA is, but it basically looks like an IRA account that you can use to invest in just about anything. They offer several different IRA “types”, so it will depend on which the LC IRA falls under to determine what other investments you can add to your account besides the LC notes. It doesn’t seem out of the question to assume that you would be able to invest in stocks and such as well. (I’ve replied to the email I got to try and determine this for sure) Based on what I was seeing on the administrators website, it was looking like the account might be pretty heavy in fees. The email from Lending Club managed to answer that question as well.

There are no fees associated with a Lending Club IRA with a balance of at least $5,000 in the first year (you have all year to reach this), or $10,000 in the second year and beyond.

If you don’t meet those requirements, the account carries a $100 annual fee. Pretty hefty if you don’t meet the requirements. There’s two ways to look at that, however. If you’re IRA is large enough, it shouldn’t be a problem to keep $10,000 in Lending Club notes and still keep your risk diversification. If you’re IRA is smaller though, you’d be automatically raising the risk of the account my meeting the requirements.

Anyway you look at it, I don’t think it will be the most popular IRA account around. But, it’s nice that they offer it for those of their customers who want a tax sheltered way to take advantage of peer-to-peer investing. You can read more over on their site: Lending Club IRA.

What are your thoughts on the Lending Club IRA? Too risky for retirement funds? Good as a part of the retirement portfolio?

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.