The role of stay-at-home dads is becoming increasingly common in today’s society, yet it remains surrounded by misconceptions and unique challenges. As more families embrace diverse parenting roles, understanding the experiences of stay-at-home dads becomes crucial. These fathers often navigate a complex landscape of societal expectations, personal fulfillment, and family dynamics. Here, we explore five significant challenges and triumphs stay-at-home dads face, shedding light on their daily lives and contributions.

Challenge 1. Social Isolation

Stay-at-home dads often face social isolation due to the traditional gender roles still prevalent in many communities. While stay-at-home moms have established support networks and social groups, dads might find fewer opportunities for social interaction. This lack of connection can lead to feelings of loneliness and alienation. Building a supportive network is crucial for combating this challenge.

Challenge 2. Stereotypes and Stigma

Societal stereotypes and stigma remain significant hurdles for stay-at-home dads. Many people still perceive caregiving as primarily a woman’s role, leading to judgment and unsolicited advice. These outdated views can affect a dad’s self-esteem and sense of accomplishment. Overcoming these stereotypes requires resilience and a shift in societal attitudes.

Challenge 3. Financial Pressure

Stay-at-home dads may experience financial pressure as they transition from a traditional breadwinner role to a caregiving role. This shift can lead to stress about contributing financially to the household. Additionally, societal expectations about male financial responsibility can exacerbate this pressure. Open communication and financial planning with their partners are essential to managing this challenge.

Challenge 4. Lack of Male Role Models

The scarcity of male role models in the caregiving sphere can make it difficult for stay-at-home dads to find guidance and inspiration. This lack of representation can leave them feeling unsure about their parenting decisions. Connecting with other stay-at-home dads and seeking out positive role models can provide much-needed support and validation.

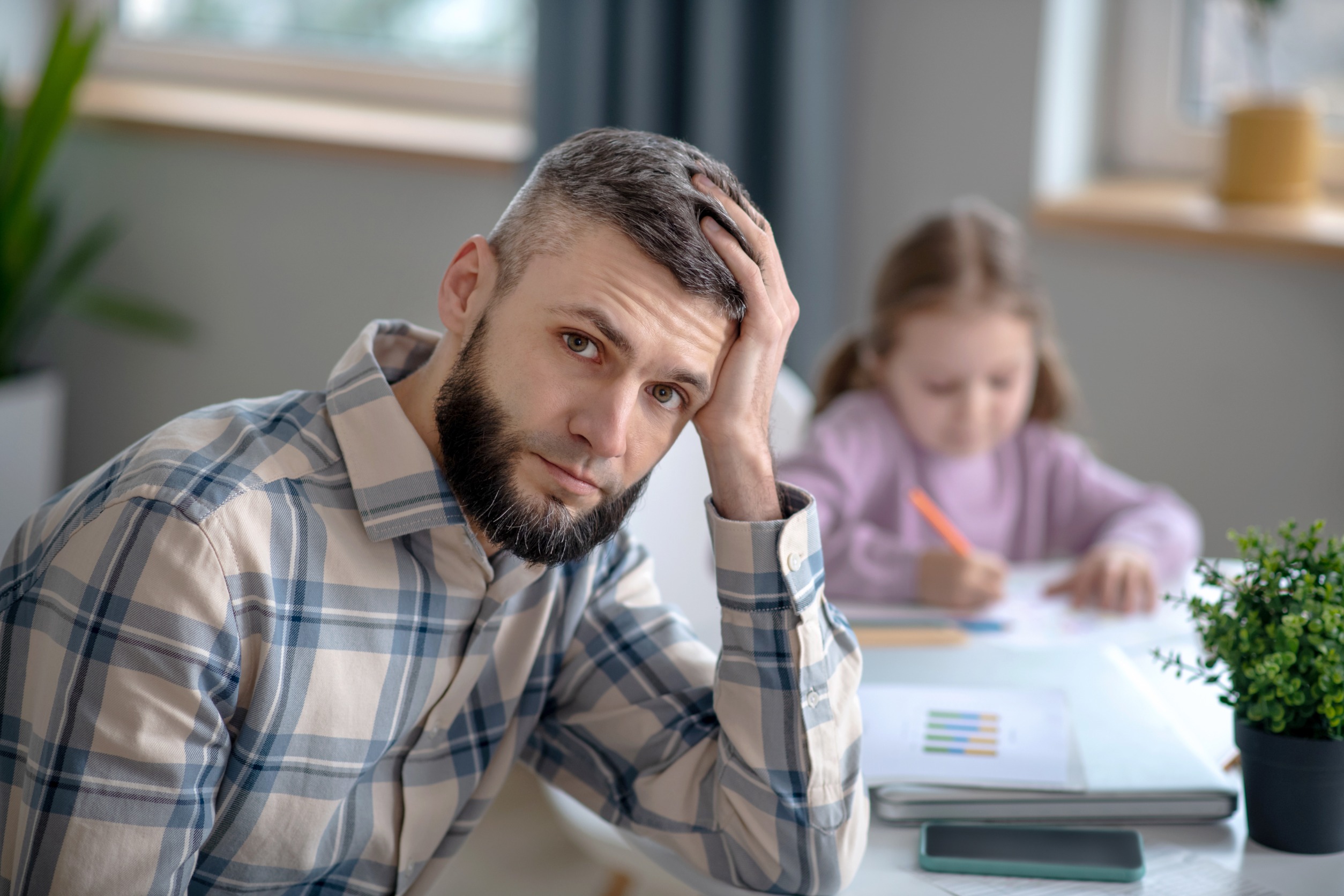

Challenge 5. Balancing Household Responsibilities

Balancing the diverse responsibilities of managing a household while also ensuring quality time with children can be overwhelming. Stay-at-home dads must juggle cooking, cleaning, and childcare, often with little recognition. This multitasking can lead to burnout if not managed properly. Establishing routines and sharing responsibilities can help mitigate this challenge.

Triumph 1. Deep Bonding with Children

One of the most significant triumphs for a stay-at-home dad is the deep, meaningful bonds they form with their children. Being present for their children’s milestones, daily routines, and challenges fosters a unique connection. This close relationship can have lasting positive effects on a child’s development and well-being. The emotional rewards of this bond are immeasurable.

Triumph 2. Challenging Gender Norms

Stay-at-home dads play a crucial role in challenging and changing traditional gender norms. By embracing caregiving roles, they set an example that parenting responsibilities should be shared equally. This shift helps normalize diverse family dynamics and promotes gender equality. Their efforts contribute to a more inclusive and balanced society.

Triumph 3. Personal Fulfillment

Many stay-at-home dads find personal fulfillment in their caregiving roles. The opportunity to nurture, teach, and watch their children grow provides immense satisfaction. This role allows them to develop new skills and discover strengths they might not have realized otherwise. Personal growth and fulfillment are significant triumphs for these fathers.

Triumph 4. Improved Family Dynamics

Having a stay-at-home dad can improve overall family dynamics by promoting a balanced distribution of responsibilities. This arrangement can lead to stronger partnerships and better communication between spouses. Children benefit from seeing both parents actively engaged in caregiving. A harmonious household often results from this shared approach to parenting.

Triumph 5. Inspiring Future Generations

Stay-at-home dads serve as powerful role models for future generations, demonstrating that caregiving is not limited by gender. Their presence helps children understand the value of equal parenting roles. This inspiration can shape more progressive attitudes in the next generation. By leading by example, they contribute to a more equitable future.

Stay-at-Home Dads Are on a Unique Journey

Stay-at-home dads navigate a complex array of challenges and triumphs, each experience shaping their unique journey. Despite societal hurdles, these fathers continue to break down barriers and redefine traditional parenting roles. Their contributions to family life and society at large are invaluable, highlighting the evolving nature of modern family dynamics. Understanding and supporting stay-at-home dads is essential for fostering a more inclusive and equitable world.

Read More:

10 Things ‘Poor’ Parents Teach Their Kids That ‘Rich’ Parents Don’t

Car Buying Tips for New Parents

Catherine is a tech-savvy writer who has focused on the personal finance space for more than eight years. She has a Bachelor’s in Information Technology and enjoys showcasing how tech can simplify everyday personal finance tasks like budgeting, spending tracking, and planning for the future. Additionally, she’s explored the ins and outs of the world of side hustles and loves to share what she’s learned along the way. When she’s not working, you can find her relaxing at home in the Pacific Northwest with her two cats or enjoying a cup of coffee at her neighborhood cafe.