In a world where financial landscapes are ever-evolving, the last decade has seen a myriad of trends that have divided experts and the public alike. From the meteoric rise of cryptocurrencies to the resurgence of gold as a safe haven, these trends have not only shaped investment portfolios but also sparked intense debates among financial aficionados. Below, we delve into the 15 most polarizing financial trends that have defined the decade, offering insights into their origins, impacts, and the controversies they’ve stirred.

1. The Cryptocurrency Craze

Cryptocurrencies, led by Bitcoin, have arguably been the most divisive financial trend. Proponents laud their potential to democratize finance, offering a decentralized alternative to traditional banking systems. Critics, however, warn of their volatility, regulatory uncertainties, and potential for misuse. The debate reached a fever pitch when Bitcoin’s value skyrocketed, making millionaires overnight and leaving skeptics questioning the sustainability of such digital assets.

2. The Rise of Neobanks

Digital-only banks, or neobanks, have disrupted traditional banking by offering user-friendly, technology-driven services. While many appreciate the convenience and innovation they bring, others question their security and long-term viability. The lack of physical branches and the reliance on digital interfaces have not sat well with everyone, leading to a polarized reception among consumers.

3. Sustainable Investing

Sustainable, responsible, and impact investing (SRI) has gained traction, driven by a growing awareness of environmental, social, and governance (ESG) issues. While many investors are eager to align their portfolios with their values, critics argue that the focus on ESG criteria may compromise returns, sparking a debate on the balance between ethics and profitability in investment strategies.

4. The Return of Gold

In times of uncertainty, investors traditionally turn to gold, and the last decade was no exception. The resurgence of gold as a safe haven asset has been met with mixed reactions. Some view it as a wise defensive move, while others see it as an outdated investment, especially in the digital age.

5. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms have revolutionized the way individuals borrow and lend money, bypassing traditional financial institutions. Advocates praise the accessibility and competitive rates it offers, but the lack of regulation and higher risk of default have raised significant concerns.

6. The Gig Economy and Financial Security

The rise of the gig economy has transformed traditional employment models, offering flexibility and autonomy. However, this trend has sparked a debate about financial security and the lack of benefits such as pensions, health insurance, and stable income, highlighting a divide in the workforce’s perception of financial stability.

7. The Explosion of ETFs

Exchange-traded funds (ETFs) have become increasingly popular for their low costs and simplicity. While they are hailed for making investment more accessible, there is a growing concern about market volatility and the “dumbing down” of investment strategies, with some experts warning of potential bubbles.

8. Tech Giants’ Financial Ventures

Tech companies venturing into financial services have drawn both excitement and skepticism. The prospect of innovation and enhanced consumer experiences contrasts sharply with fears over privacy, data security, and the concentration of power among a few tech behemoths.

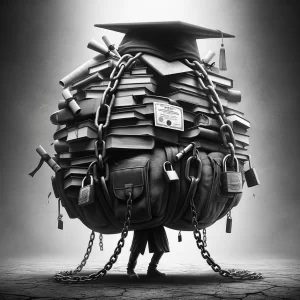

9. The Student Loan Crisis

The burgeoning student loan debt has become a hot-button issue, with calls for reform clashing with debates over personal responsibility and the value of higher education. The financial strain on millions of Americans has led to polarized views on the role of education in society and its financial implications.

10. Negative Interest Rates

The phenomenon of negative interest rates in some economies has upended traditional financial wisdom, leading to a split in opinion. Some see it as a necessary tool to stimulate economic growth, while others view it as a dangerous experiment with potentially dire consequences.

11. The FIRE Movement

The Financial Independence, Retire Early (FIRE) movement advocates for extreme savings and investment to achieve early retirement. While it has a dedicated following, critics argue that it is unrealistic for most people and overlooks the value of career fulfillment.

12. Real Estate Crowdfunding

Crowdfunding has made real estate investment more accessible, but opinions vary widely. Enthusiasts appreciate the democratization of property investment, while detractors highlight the risks associated with a lack of liquidity and the potential for market saturation.

13. The Revival of Value Investing

In a decade dominated by high-flying tech stocks, the return to value investing has been contentious. Some investors see it as a timeless strategy for long-term success, while others argue that the digital age requires new approaches to stock valuation.

14. Big Data in Finance

The use of big data and AI in finance has been both celebrated for its potential to enhance decision-making and criticized for privacy concerns and the potential for algorithmic biases. The debate centers around the balance between technological advancement and ethical considerations.

15. The Shift Toward Cashless Societies

The move towards cashless transactions has been accelerated by technological advancements and the pandemic. While many herald this as a step towards greater efficiency and security, others worry about privacy, cybersecurity, and the exclusion of those without digital access.

Financial Trends Showcase the Complexities of Modern Finance

These polarizing financial trends highlight the dynamic nature of the financial landscape and the varying perspectives individuals hold. As we navigate through these trends, the debates they spark are a testament to the complexities of modern finance and the diverse values and priorities of those it serves.

Catherine is a tech-savvy writer who has focused on the personal finance space for more than eight years. She has a Bachelor’s in Information Technology and enjoys showcasing how tech can simplify everyday personal finance tasks like budgeting, spending tracking, and planning for the future. Additionally, she’s explored the ins and outs of the world of side hustles and loves to share what she’s learned along the way. When she’s not working, you can find her relaxing at home in the Pacific Northwest with her two cats or enjoying a cup of coffee at her neighborhood cafe.