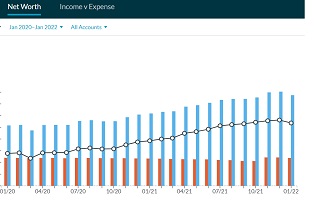

For years, I’ve tried to get one month ahead of my budget. This is based on the You Need a Budget rule number four: age your money. The idea is that you spend the money you earned last month this month. Finally, this past January, my husband and I were able to do this, and in the last few months, we’ve realized several benefits of budgeting one month ahead.

However, I want to recognize that putting together enough money to budget one month ahead is tough! We needed years to do this because our money was always so tight. However, we feel relieved now that we’ve finally reached this step.

3 Benefits of Budgeting One Month Ahead

Here are three times budgeting one month ahead protects your finances:

When Pay Day Falls Later in the Month

My husband is the primary breadwinner; his check comes every other week. That means that some months, his check will come at the end of the month, which makes paying bills at the beginning of the following month easy. However, sometimes, his check won’t come until the 8th or 9th of the month. If we’re not ahead in our budget, we’re short money to pay bills at the beginning of the month.

However, budgeting one month in advance took care of this problem. Now, I can pay our bills on time, in full, because when we start the month of July, for instance, all the money I need is in the budget. After all, I used June’s paychecks to fund July. This is freeing!

When Paychecks Are Delayed

I work as a freelancer and make about 20 percent of our household income. However, my money is allocated to pay for groceries and a few other budget categories. Recently, not one but two of my employers were delayed in paying me. Had we not been one month ahead in the budget, we would have had to shuffle some money around to have money for groceries.

However, I didn’t have to worry because I had budgeted ahead. I got both paychecks about two weeks late, but it wasn’t a big deal. I simply took the money when I received it and budgeted it for the upcoming month.

Defacto Emergency Fund

When you budget one month ahead, that money counts as part of your emergency fund. If anything happens, such as job loss, a reduction in hours, or, as in my case, delayed payments, you have next month covered so you have a financial cushion.

In addition, if you’re tempted by money sitting in an emergency fund, budgeting it one month ahead tends to reduce the temptation because you’ve already allocated how the money can be used next month.

Final Thoughts

We’ve realized several benefits of budgeting one month ahead in the few months since we’ve been able to do it. Who knows? Now we may try to work our way up to budgeting two months ahead. Then, we’ll be one step closer to a six-month emergency fund.

Read More

How Getting Ahead Saves Time, Money, and Mental Energy

Why You Need a Budget If You’re Broke

Yes, Incremental Budgeting Is A Thing

Melissa is a writer and virtual assistant. She earned her Master’s from Southern Illinois University, and her Bachelor’s in English from the University of Michigan. When she’s not working, you can find her homeschooling her kids, reading a good book, or cooking. She resides in New York, where she loves the natural beauty of the area.